AN ANALYSIS OF THE IVEY CASE “CHABROS INTERNATIONAL GROUP: A WORLD OF WOOD”

Executive Summary

With the onset of the global financial crisis in 2008, Chabros International, a wholesaler and manufacturer of lumber and veneer, suddenly found themselves facing financial issues only a year later. Their expansionist policies of the past few years have returned and faced them as part of a glaring problem with their continued international growth strategy within the MENA (Middle Eastern and North African) region. Given limited resources and even fewer choices, the company needs to figure out whether they are to further expand their operations in newer markets in order to shore up the loss of demand within current domestic markets or whether to divest their Serbian lumber mill facility, a key competitive advantage they’ve built themselves over the past few years (by exploiting the dichotomic manufacture-wholesaler operational model). Through an extensive internal micro as well as external macro analysis using different models to look beyond than what is presented on the surface. The company is strongly suggested to pursue the path of further expansion into foreign markets within relatively stable MENA countries with decently sized markets in order to shore up their demand shortage and continue to operate their dichotomy model that has worked well for the company so far. Through this strategic change the company will leverage its existing advantages in the new foreign market of Morocco, a country without any major dominant players within the veneer and European lumber industry, and gain a solid market share within the coming fiscal year to help endure the economic recession. At which point when the conditions better then the new Morocco subsidiary will bolster its efforts in capturing a major share in the market before other multinational competitors enter into the domestic fray. Thereby granting Chabros a first-mover advantage and helping them relieve their financial duress.

Background

Founded during the 1960s, Chabros was a Lebanese-based company that had originally dealt with the trading wholesale of veneer, thin slices of would made for decorations on wooden furnishings. The company is held and led by the Chami brothers, and later expanded their products to include wood and lumber as well, but due to extenuating political and economical situations within Lebanon during the late 1980s and early 1990s, Chabros seeked buyers of their products from surrounding countries. After having achieved domestic success within Lebanon’s stabilized post-civil conflict market, they strived for international growth, with the first branch office subsidiary opening in Dubai in 1999. Chabros Dubai proved to be a huge success within the coming years and would eventually come to be the largest source of Chabros yearly sales and profits. With the success of their international expansion to Dubai, the firm continued to fuel its international growth with the expansion into other MENA (middle eastern and North African) countries. Starting with an International Joint Venture in Saudi Arabia along with 2 like minded Italian suppliers, the firm has over the years rapidly expanded their area of operations to Qatar, Oman, and Egypt. With the last subsidiary being opened in Egypt, Chabros utilized this opportunity to expand their product lines by offering the local Egyptian market cheaper, lower quality “B” ranked veneer, exploiting a market deficiency and leveraging it for the company’s long-term success. By 2009, Chabros had established a dominating international presence within the MENA area with 8 subsidiaries established in 6 foreign markets excluding Lebanon, with every country having access to at least one local office and UAE and Saudi Arabia having 2, the firm had expanded its scopes from being just a high quality (A, AB rank) veneer trader to partaking in the manufacturing process of veneer and lumber as well with its Serbian lumbermill subsidiary. Chabros recent purchase of their Serbian lumber mill had recently received funds and resources to expand, spending $11 million to further increase the production capacity to satisfy the company’s demand for European wood. Currently, Chabros is an international presence within the wood and veneer industry that competed with other multinational entities of similar size. Products are imported from all over the globe, helping bolster their expansive products lines and these products were then on their way to one of the local markets in each of the 7 countries the company held presence in.

Problem Definition

From 2005 to 2008, Chabros experienced tremendous growth in sales volume and revenues, achieving a 67% growth within 2 years reaching a grand total of $100 million total sales figure. However, with the onset of the economic recession of 2008, the sales figures started to falter, and the company outlooks seemed increasingly bleak as time passed. Their record high of $100 million sales figure had diminished to by 10% to $90 million. In 2009, Chabros most profitable subsidiary Chabros Dubai, suffered the largest hit of the recession, a 30% drop in sales and only contributed $35 million to the firm’s total sales that year opposed to the $50 million the market operations could achieve the year prior. Suddenly, the company’s average profits margins dropped from the stable average of 6.4% to a frighteningly low 4.2% for the year. With dire financial situation that the company finds itself bogged down in along the global economic recession, the recent investment into their Serbian lumber mill subsidiary seemed to loom over the company’s top management as a catalyst for the company’s decline. Should Chabros shut down a section of their lumber mill and reduce capacity and expenses related to that subsidiary in order to avoid the problem of overproduction? Or should the company reinvigorate their growth strategy and expand into other countries with the hopes of being able to increase market demand to match their production at full capacity? Even among growth increasing strategies, the firm has a choice between concentrating their efforts within market penetration, product development, market development, and diversification. Chabros currently, is being forced to decide on the path that will yield them the most optimal results going forward into the future; either that’s bolstering their expansion and development to match sales and demand with their overcapacity production or cut down on costs and production to ride out the recession.

Key Criteria

The Key criteria here for a plausible solution for Chabros current situation would be to reduce financial pressure, to achieve that Chabro’s options are limited in a variety of ways. To start with, Chabros can only undertake expansion projects that pertain a high possibility of returning yield on their investment within the coming fiscal periods, as any longer a time delay for the firm to see returns on their investments would put the company into further and increasingly dire straights of financial instability. Therefore, when looking along expansionary strategies, the firm must be able to perform some level of extensive market research, including market and economic conditions, potential demands for products and supplier availability among others beforehand and ensure that the expected benefits are at a level that is acceptable for their current situation. Secondly, if the firm goes towards the route of cutting costs and mitigating losses for the near future, top management must realize that costs cut present time will be losses of available resources in the future, especially when regarding their Serbian subsidiary. As all losses of human talent and will be required to rehire in the future after the recession passes and along with that comes with additional costs (training, HR, recruitment) that would not have occurred if the capacity of the facility is not reduced. On top of that, all other sunk resources will be lost, and a time delay period will also be incurred when the firm decides to return to full capacity. Finally, Chabros should seek to maintain their current competitive advantages during this period, many of the competitive advantages for the firm are extremely valuable and they are the cornerstones of the company’s rapid growth. As such, the firm should be extremely reluctant to give any of these up in hopes of cutting costs in order to preserve what their key leveraging capabilities are going forward into the long-term future.

Internal and Industry Analysis

Diamond-E Framework

Inference – seen above within the framework that the current inner working of Chabros is very meticulous and they play well to their strengths while showing little weaknesses. They have many advantages from which to leverage to their benefit when considering both expansionary and recessive strategies, as is evident of their great relationships built with international suppliers which no doubt can be partly attributed to the flexible mentality of their culturally-open minded employees. Their management experience and style are very suitable for the multinational subsidiary based organizational structure they have built around themselves and they do not back off from the possibility of risk.

Porters 5 Forces Model

Inference – There seems to be little threat from external entries and product substitutions for Chabros, but their attentions should be placed upon the current competitors within this highly competitive market. Current and future supplier relationships are key to maintaining competitive advantage within this industry especially when Chabros are to continue their strategy of quality selection over quantity in order to satisfy buyer demand.

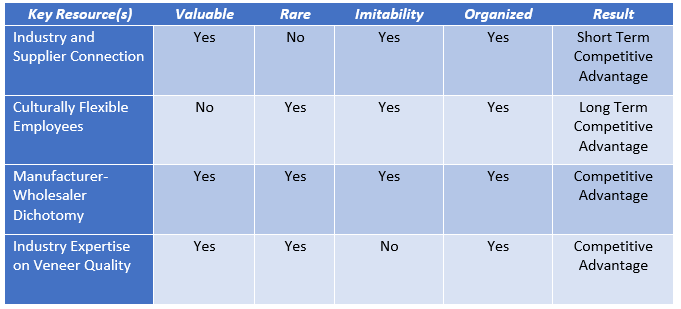

VRIO Analysis of Core Competencies

Inference – The few key core competencies for Chabros are all very well organized, the firm is utilizing and leveraging their advantages to their utmost limits in their operations and strategy. While many are imitable in the long-term by their competitors, Chabros can ensure to gain a dominant market share within that given period of time on a global scale before similar sized competitors can boast similar competencies. Their expertise on carefully procuring the finest collection of veneers represents their greatest asset and they should seek to continue to leverage this into future operations.

External and Country Analysis

PESTELID

Inferences – The biggest external macro factor is the general slowing down of the global economy due to the recession. As a side effect of this, current suppliers may seek to limit their engagement with Chabros within the foreseeable future, current debtors of the company may default on their accounts owned. However there is a silver lining and that is the slowing down of competitor movement within the markets as well for they are suffering from the same conditions, therefore it may be optimal to undertake growth strategies where there will be fewer obstacles and resistances presented by competition.

Country Analysis

Morocco

From a basic rundown of the SWOT analysis, the market conditions in the country is both encouraging and discouraging depending on Chabro’s point of reference. The fact that there are no serious local rivals means that Chabros can focus on maximizing their operational efficiencies when initially penetrating into the market if they are to decide to do so and ensure a major foothold within the market share within a short amount of time due to the fact that there is a lack of domestic suppliers for veneer. To top off that, the economic stability presently exhibited by the local markets reduces the amount of risks that are presented with the market diversification strategy. Coupled with that is the stability of the local currency, being strongly tied to the Euro indicates even greater risk insurance against economic instability. On the flip side, domestic contracts are monopolized by key supplier firms, and while there is a reduced possibility of entry from current international competitors as is laid out within the PESTLEID analysis, it is still necessary to be cautionary of the local businesses forming anti-foreign businesses alliances with one another, which will only hinder Chabros entrance into the market and slow down the gain of shares within the market. The lack of domestic connections within the local industry and the firms already lacking brand image and reputation will draw hesitation from even potential suppliers and buyers which will only further complicate the process for the firm to gain a solid foothold.

Morocco has very fiscally conservative policies against foreign businesses trying to invade its market. With its high tariffs on veneer boards added onto an above average income tax percentage, it might prove difficult to breakeven within the first few years of operations. Even looking beyond that, the tax rate of 30% after 5 years is beyond reasonably high when compared to Saudi Arabia’s 20% corporate income tax. That said, the country does have ideal political and social economic conditions, with a rather stable political climate that’s only tainted slightly by its infrastructure support for ease of doing business (which is ranked 128 out of 183). However, with the countries economic indicators for current market and consumer wealth as well as future growth rate being just above average when compared to the other MENA countries, a potential expansion into Morocco should be thoroughly researched and deliberated upon.

On the other hand, alternative potential candidates such as Kuwait and Jordan seems to be more appealing and may prove to be more fruitful for Chabros to look into for future market expansions. As both pertain to similar if not better political climates which boasts and indicates stability within the region for the foreseeable future; they both also hold a higher position on the commercial system scale for ease of doing business (61 and 100 for Kuwait and Jordan respectively). Although the only downside towards these two markets is the lacking size, as both are states with smaller landmasses and fewer population, thereby limiting the size of the potential demand within the market for Chabro’s products.

Key Assumptions

- Chabros still have the resources and capacity to perform expansionary strategies if they are to undertake them.

- That international and domestic businesses and institutions will not alliance together and form an obstacle for Chabros diversification if they choose to do so.

- That if Chabros were to divest the Serbian subsidiary that it would be sold off at a reasonable market price, covering for a majority of the expenses paid for the acquirement and expansion of it in the first place.

- If left untouched, the Serbian subsidiary will produce amount of inventory that is larger than demand for the firm and that the demand within current local markets will not increase for the foreseeable future.

- Current market shares within the veneer sectors are not near full domination (>80%) and that further market penetration is possible.

- Chabros can self sustain for one more fiscal period on its own in order to for the change in strategy to start taking effect.

- Recession is short-term and economies will recover within the near future.

Alternatives

- Divesture of the Lumber Mill Facility: This option will prove to be the risk free option for Chabros to get through the financial pressure without incurring any unforeseen outcomes that other options do not offer. By divesting the subsidiary, Chabros is essentially giving up the dichotomy organizational structure that they have built many of their strategic policies around, as well as the competitive advantage of being able to manufacture their own supply of lumber and veneer for the foreseeable future. Giving a chance for other multinational competitors to potentially take up this key strategy as one of their own after the recession ends.

- Diversification into foreign Markets (Morocco): This option will prove to be risky within the current economic state of the global economy. If done poorly then the entire entirety of Chabros may collapse under increased financial pressure being put on by proceeding with this plan of expansion. However, if done successfully, not only will Chabros succeed in alleviating their financial pressure but they will also keep their competitive advantage of the dichotomy of being both manufacturer-wholesaler, which will surely lead to greater future benefits down the road. However Morocco proves to be the most economically stable target for expansion. Although potential conflicts with local businesses and institutions may arise during the process, the domestic market proves to be large enough for Chabros to satisfy their lack of demand if expansion is successful. Added on top of that it pertains very close ties with the EU and therefore insures many of the risks involved in choosing to expand during the recession.

- Diversification into foreign Markets (Others): Similar to the previous option, this will allow Chabros to expand into a new foreign market (Jordan or Kuwait is recommended to be looked at with interest). However these other markets may not prove to be fruitful as most of the surrounding MENA countries that have yet to be penetrated are either too small to be impactful on the companies financial pressure as a whole or too economically or politically unstable to risk expanding into. With only Kuwait and Jordan seemingly like acceptable alternatives, but even they have their detriments when compared to the conditions that are present within Morocco.

- Product Development/Market Penetration within Existing Markets: With this option it proves to be less risky than diversification into a foreign market where all the basic foundations of a new subsidiary needs to be setup for a period of time before operations can start running smoothly and efficiently if proven to be successful. By focusing on currently penetrated domestic markets and furthering development, Chabros can hope to achieve a bigger market share and extract even more of the demand from the domestic buyers. Some risks are still involved as the efforts may still prove to be less than optimal and result in less demand than necessary to bridge the gap between Chabros production capacity.

Valuation Table of Alternatives

Recommendation and Action Plan

From the analysis and from evaluating the alternatives and options presented to Chabros, it seems like the best possible choices for the firm would be to either expand into Morocco or to divest their lumber mill facility in order to alleviate their financial pressure. Being a tough decision between the two to make, it should be noted the history and management preference of the company and all its past decisions. This is a firm with a history of taking calculated risks and not backing down when confronted with potential growth and gains if it meant taking on moderate risks, as is evident from their rapid expansion during the early and mid 2000s within the MENA region. Therefore the key solution for Chabros going forward would definitely be the expansion of their operations into Morocco, which promises the most optimal expected results factoring in the risks as well as the fact that they will not give up on their current competitive dichotomy manufacturer-wholesaler advantage that they have built themselves within the past few years. The sunk costs of the subsidiary itself should be discarded and not factor into the decision of the company as it currently stands going forward into the future. The company should leverage its current competitive advantages such as their flexible employee attitudes, which is perfect for a situation like Morocco who have strong ties with European culture, economies of scale within the MENA region, knowledge and expertise of the veneer industry in an otherwise unexploited “blue-ocean” domestic market with little to few competitors. Coupled with the fact that other multinational competitors are doing as little as they can to stabilize and presents no threat towards Chabros entry into the market. All of these factors culminate in the perfect environment for which Chabros can leverage their advantages to mitigate the risks that they might face in the onset of this global recession in order to gain back the stable financial foothold they lost prior to the start of the economic downturn.

Recommendation Cost-Benefit Analysis

Forecast Action Plan

References

- Case File Appendices

- https://tradingeconomics.com/jordan/corporate-tax-rate (Jordan, Kuwait and Saudi Arabia corporate tax rate)

- https://www.state.gov/e/eb/rls/othr/ics/2015/241612.htm#1 (US Department of State report on Jordan Investment Climate 2015